Though market fluctuations can make the world of real estate investing somewhat harrowing at times, it really is possible to generate substantial income by being in the game. To maximize your wealth potential by investing in properties, it is necessary to do your homework. Start with the advice below and never stop learning.

Before investing in real estate, try analyzing the market and researching thoroughly. Select a location, pick out a number of properties, and then go inspect and compare them. Compare things like the costs of repairs, desirability of location and potential return on your investment. Thinking about these factors can assist you with separating good deals from bad deals.

Learn all you can before you start investing in real estate. By doing good research, you will learn all the ins and outs of the business. It is recommended that you research as much information as possible to better your chances of success.

If you purchase a property and need to make repairs, be wary of any contractors who ask for money in advance. You should not have to pay before the work is done, and if you do, you run the risk of getting ripped off. At the very least, never pay the http://marketingartfully.com/2013/06/19/real-estate-marketing-100-great-seo-keywords-for-realtors/ full amount ahead of time.

Try not to overextend yourself. Don't get overeager. Start small and work your way up. Don't just assume that you can spend a great deal and make that money back. That's an easy way to back yourself into a corner. Wait until your smaller investments can fund some of your more ambitious ones.

If you are looking to buy a rental property from a seller, ask to see his Schedule E tax form. That particular document will honestly tell you what kind of cash flow you can expect from the property in question. Crunching the numbers tells you all you need to know about whether or not to buy.

Educate yourself on the basics of investing in real estate prior to spending your hard earned money. A mistake in this field can cost you thousands of dollars. Spending money to gain education is always a wise move.

Stay away from deals that are too good to be true, especially with investors that you cannot trust or do not have a good reputation. It is important to stick with those who have a good reputation because getting ripped off in this business can cost you a lot of money.

Understand that real estate investing is a commitment. You may have heard a lot about flipping properties quickly for profit, but the reality is you are more likely to make good profits by purchasing carefully and managing the property wisely until property values increase. Purchase a property that will attract solid tenants for steady, ongoing income.

The best real estate investment you can make is purchasing and renting out one bedroom condos. Most people that are in the market for a rental property are single may they be young singles, divorced middle-agers or older widowed people. It is not only the easiest property to rent, but also the simplest to manage.

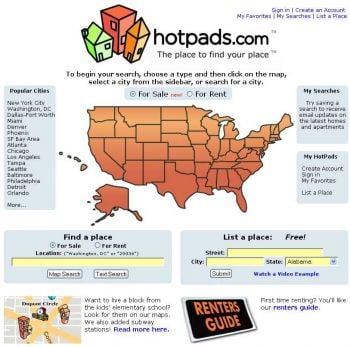

Do your research prior to investing in real estate. Most municipalities have an official website. Look for city planning details. This will give you an idea of whether your property investment will pay off. Growing cities tend to be good investment opportunities.

Begin with a single parcel of property. While it might be tempting to buy several properties at one time, it can be a mistake if you are new to real estate investing. You are better off beginning with a single property and allowing yourself to become familiar with this excellent investment. You will find long-term success with this.

Never give up! Real estate investing is not a simple thing to jump into. There's a lot to learn, and you should expect quite a few bumps and bruises along the way. But with patience and increased skills from playing the game, you'll become better and better at it.

Once you set up an investment plan, get someone else to take a look at it. Even if the person is not an expert in the field, they may be able to point out some things that just are not going to work. An expert, though, can help you adjust your plan to make it more suitable for your needs. They may also be able to talk to you about marketing as well.

If you are interested in investing, there is no time like the present. Procrastination is a big mistake in the real estate market. The longer you wait, you'll find yourself a step behind others.

As you expand your business of real estate investing, make sure to expand your network of contacts as well. People are often just as important as properties, because they can give you exclusive investment offers before they become available to the public. An expansive network can also provide opportunities in selling a fantastic read that you would not have otherwise known about.

Don't be taken in by slick talkers who boast that they made millions in real estate and that they can teach anyone to do it. The success stories always get more attention than the failures so don't pin your hopes on being the next success story. There are no get rich quick methods that are sure things.

When investing in real estate in today's world, it's important to take notice of "green" features within a home. Today's perception of the "value" of these types of modifications is trending forward, so this can affect future transactions immensely regarding the properties you purchase, whether you rent or sell.

Have a business account, and stick to using it. If you invest too much of your personal money in a property, you could lose money. This might leave you short on funds to pay your bills or take care of personal needs. Treat this like a business so you don't risk losing it all.

Remember, you should only invest money that you could lose without causing seriously financial pain to your family. This means that going into debt to invest or using equity from your family's current home is not the right solution. Find other sources of income to protect yourself from the worst possible situations.

If you wish to make major income using real estate investments, don't delay anymore. Given your new insight from this article, you should be nearly ready to cut an initial deal. Keep this information on hand as you begin and use it to boost your success.